Common Mistakes First-time Homebuyers Make – and How to Avoid Them

Common Mistakes First-time Homebuyers Make – and How to Avoid Them

Buying your first home is both a thrilling and scary experience. There are plenty of pitfalls along the way, but by avoiding some common mistakes your home purchase is more exciting and less stressful.

Buying your first home is both a thrilling and scary experience. There are plenty of pitfalls along the way, but by avoiding some common mistakes your home purchase is more exciting and less stressful.

Get Pre-Approved

Don’t assume you will qualify for a specific mortgage amount without visiting a lender. Many factors influence the amount you’re able to borrow.

Don’t assume you will qualify for a specific mortgage amount without visiting a lender. Many factors influence the amount you’re able to borrow.

Home Inspection

First-time homebuyers usually know they must have their house inspected, but may think it’s not necessary when purchasing new construction. Even when everything is brand-new and the building meets local codes, there’s always a possibility something is wrong. Spend the money to hire a certified home inspector, rather than use a friend familiar with construction. Accompany the inspector on the visit so you can ask questions.

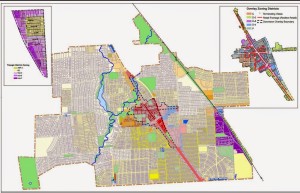

Check the Zoning

You love the neighborhood. There’s lots of open space – it’s idyllic. Before you make an offer, check the area’s zoning. That lovely old farm down the road might be zoned for hundreds of townhouses, or for commercial or industrial use. It’s crucial for your home’s value and your enjoyment of it that you know how the area could change.

You love the neighborhood. There’s lots of open space – it’s idyllic. Before you make an offer, check the area’s zoning. That lovely old farm down the road might be zoned for hundreds of townhouses, or for commercial or industrial use. It’s crucial for your home’s value and your enjoyment of it that you know how the area could change.

Cost Considerations

Many first-time homebuyers are so focused on the mortgage that they fail to take other costs into consideration. These include:

- Closing costs

- Property taxes

- Homeowners Insurance

- Utilities

If a property is in a townhouse community, condo project, or otherwise subject to an HOA (Homeowner’s Association), you’ll owe regular HOA dues for maintenance, clean up, and upkeep. Basically, the HOA will keep the neighborhood pretty for you and your guests.

Private Mortgage Insurance

- Any purchase on a conventional mortgage with less than 20 percent down on the home requires PMI (Private Mortgage Insurance). There are options available that will make PMI easy to deal with. Be sure to ask your mortgage broker on how to waive PMI and other PMI options, including:

- Upfront PMI

- Instant PMI

- No PMI or waived PMI (lender paid)

- Borrower Paid

- Monthly PMI

Mortgage Contingency Clauses

You’re dreaming of closing on your home when a huge wrench is thrown in the works. Perhaps you’ve received a pink slip, or the dwelling’s appraisal price turns out much higher than the purchase price. If there’s a contingency clause in your mortgage financing, such situations negate the agreement and you should get back the funds you put down as security.